Never feel outnumbered with QuickBooks’ simple, smart accounting software. Save time and effort sending invoices, managing expenses and preparing your VAT returns–all in one place. Connect your bank accounts, credit cards, PayPal, and more to pull in all income and expenses automatically. QuickBooks Self-Employed is a nice solution for freelancers and independent contractors, especially now that Self-Employed users can collaborate with sole trader accounting their accountant or bookkeeper right inside the software. That said, QuickBooks Self-Employed lacks certain features that most sole proprietorships will need eventually—if not right away. If you’re not a freelancer, you may want to look into QuickBooks Online instead.

Start using Countingup’s sole trader accounting software today

Its app is similarly easy to use and offers the same features as the cloud-based software. But while we love QuickBooks, its interface isn’t all that different from FreshBooks or Xero. All three options have a low learning curve and solid instructional videos to help you get set up. You need accounting software for your sole trader business that manages your finances without the stress. That way, you can dedicate your time and attention to providing clients with your best work instead of struggling with calculations and spreadsheets.

Professional Templates

- Wave’s smart dashboard organizes your income, expenses, payments, and invoices.

- QuickBooks Solopreneur is designed for one-person businesses, who may or may not use 1099 contractors.

- It is used by companies of all sizes to record, process, and track financial transactions, generate financial statements, and perform other accounting-related tasks.

- Once you’ve established what you want, cost is the next crucial factor.

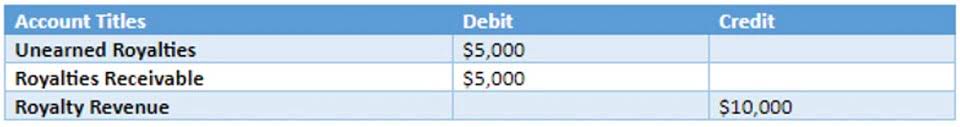

- That’s why our accounting software now includes double-entry accounting – an industry standard features that helps you keep all of your debits and credits in check.

However, this method can make it more challenging https://www.bookstime.com/ to forecast future income, so it’s not ideal for firms with big sales volumes, as it can lead to mismatched revenue and expense recognition. VT Software was founded in 1997, and its professional products (VT Accounts and VT Transaction+) are popular with small firms. Imagine being able to access real time business data from anywhere – effortlessly stay connected to your business through your phone, tablet, or laptop. If you make a purchase through the links on our site, we may earn a commission from the retailers of the products we have reviewed. This helps Startups.co.uk to provide free reviews for our readers.

of sole-trader customers agree that QuickBooks automates their accounting and bookkeeping.*

FreshBooks also stands out with impressive client interaction tools, which are less emphasised in competing platforms, making it an excellent choice if you’re keen to leave a remarkable impression on clients. Nonetheless, FreshBooks doesn’t provide the same depth of features for extensive business scaling as Xero, making Xero more suitable if you’re planning for fast growth. After April 2026, this will extend to all unless they are exempt. As a sole trader, you must use MTD-compliant software like any other business. With Making Tax Digital (MTD) rolling out, it’s advisable to get used to a digital system. It’s also much easier to keep all of your records organised when they’re on an accounting software.

- Unfortunately, it doesn’t offer as many features as either competitor.

- If you make a purchase through the links on our site, we may earn a commission from the retailers of the products we have reviewed.

- You provide important professional services to your clients.

- Sole proprietor accounting software isn’t just a key part of your business.

- You need something that’s MTD-compliant and is able to handle fluctuating income.

- For everyone else, FreeAgent costs £19 per month (or £9.50 for the first six months).

How do I find the right accounting software for my sole trader business?

Unlike Xero, Zoho Books sometimes uses terminology that isn’t the most intuitive to non-accountants. Still, with a little patience during the learning process, small businesses already in the Zoho ecosystem may enjoy working with this accounting software. Digital tools like QuickBooks exist to help small business owners like you save time — so you can turn more of your minutes into dollars.

- Follow-up work reminders ensure ongoing customer engagement, leading to repeat business and customer satisfaction.

- Free accounting tools and templates to help speed up and simplify workflows.

- Standard lets you create up to 5,000 invoices per year, while you’re limited to 1,000 on the free plan.

- Anyone who earns income must track their business finances and file tax returns.

- With good accounting—and the best accounting software for self-employed people like you—you can keep your business running smoothly.

- However, unless you’re a software whizz with a coding background, you won’t get much out of GnuCash.

With the exception of a couple of inventory-related features, it carries all the same primary accounting functions as QuickBooks Online but at a lower cost. Make the billing process as simple as possible for both you and your clients. FreshBooks accounting software allows you to set up billing schedules so your clients can pay automatically and securely by credit card every month, without having to think about it. Your clients save time and you get the financial security of knowing exactly when payments gross vs net land in your account. Businesses that use accounting systems have five times more customers than businesses that don’t, according to GoRemotely.

Best accounting software if you’re a sole trader

Any accounting software application you purchase should include double-entry accounting capability, a good support system, and easy invoicing. It’s up to you to determine what other features you’re looking for. Once you know, seek out the applications that offer those features. FreeAgent has all of the core accounting features that Zoho Books and QuickFile offer. Interestingly, it also boasts time tracking tools, so you can easily view timesheets, which makes billing clients much simpler as you’ll know exactly how many hours you’ve completed on an account each month. FreeAgent, for example, includes features that are designed to help freelancers manage their workload; such as time tracking and project management.